Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Lack of Ongoing Financial Oversight Leads to Unreliable Financial Reporting

Without periodic internal reviews, errors, leakages and compliance gaps remain unnoticed until statutory audits or investor scrutiny. This leads to Inaccurate books, unreconciled balances and inconsistent MIS result in decisions that are driven by assumptions rather than facts.

This is where EaseUp’s Financial Audit steps in!!!

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Financial Audits Services

We review maker–checker controls, approval workflows and financial processes to spot gaps & cut operational and fraud risks.

How EaseUp Makes Financial Audit Simple & Smart

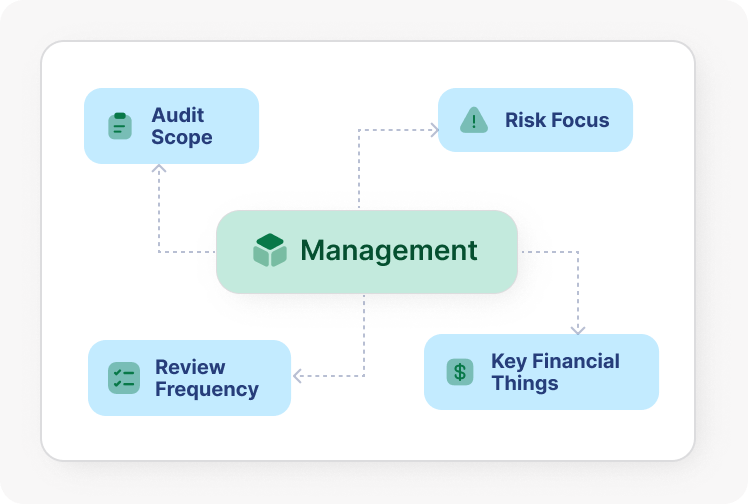

1. Scope Definition & Risk Mapping

We align with management to define audit scope, review frequency, key financial areas and risk focus based on business size, industry and regulatory exposure.

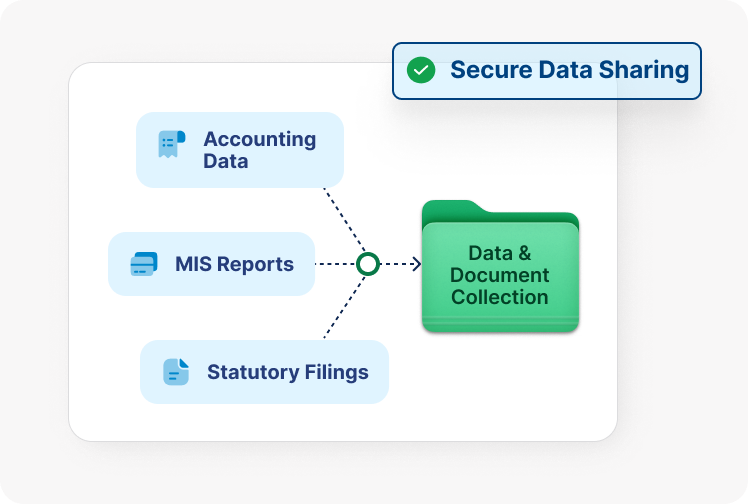

2. Data & Document Collection

We collect accounting data, MIS, statutory filings, reconciliations and process documents through a structured checklist and secure data-sharing mechanism.

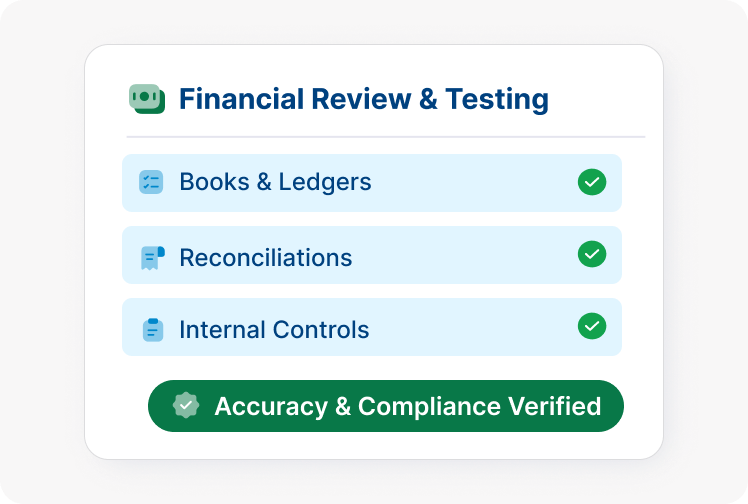

3. Financial Review & Control Testing

Our team reviews books, ledgers, reconciliations and internal controls, testing accuracy, compliance and effectiveness of financial processes.

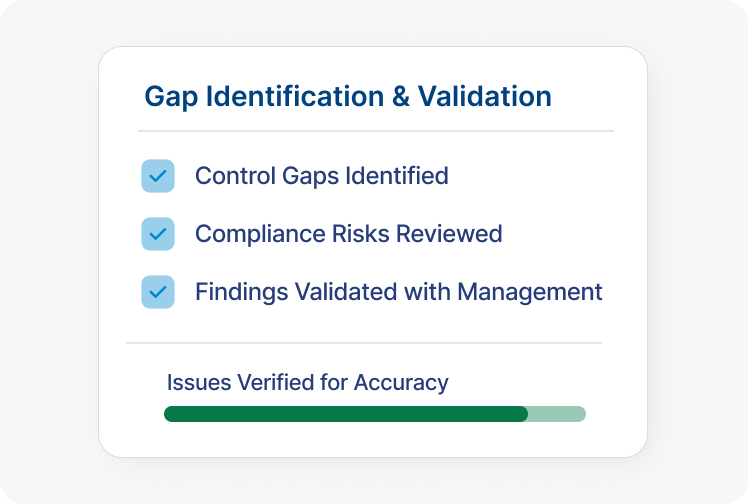

4. Gap Identification & Issue Validation

We identify control gaps, reporting issues and compliance risks & validate findings with management to ensure factual accuracy and business context.

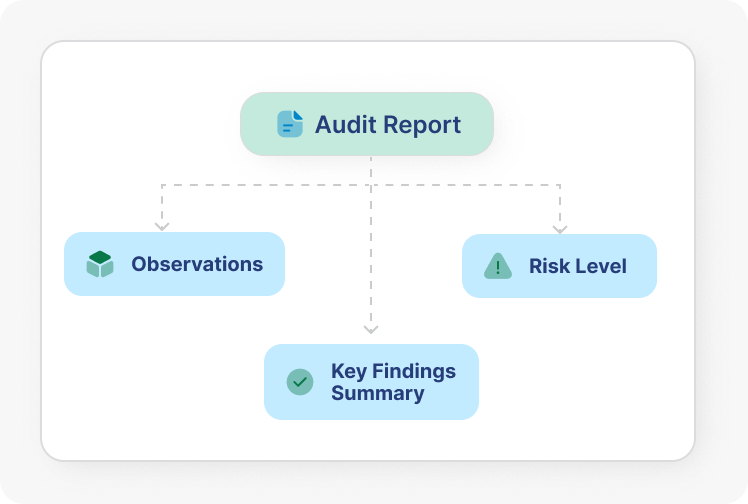

5. Reporting & Management Action Plan

We present a clear audit report highlighting observations, risk levels and actionable recommendations, along with a practical roadmap for closure and improvement.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for Financial Audit?

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready for Smart Financial Audit?

Get proactive financial oversight, stronger controls and management-ready reporting—without waiting for year-end audits.

Get Started with Stress Free Financial Audit Journey

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Scope Your Financial Audit

We learn about your business, set clear audit goals, decide how often to review and focus on key risks to create a financial audit plan that meets your management needs.

Share Financial Data Securely

We gather books of accounts, MIS, reconciliations and compliance records using a clear checklist and safe data-sharing method with little disruption.

Review, Report & Strengthen Controls

Our experts review your finances closely, spot risks and gaps & provide clear, action-ready reports to help you improve controls and make better decisions.

FAQs

Legal Queries Solved

A Statutory Audit is mandatory under law to provide an opinion on true and fair financial statements. An Internal Audit is voluntary and focuses on improving internal controls, risk management, and operational efficiency.