About Us

Build Lasting Personal Wealth with a Clear Financial Strategy

Don’t let business growth compromise your personal financial stability. We design a comprehensive plan focused on tax efficiency, strategic investments and protecting your family’s wealth beyond your business.

95%

Client Satisfaction

150+

Trained Caregivers

80+

Families Served

Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Founders Always Overlook Their Personal Investments

Founders focus all their energy on their business, often leaving their personal investments unmanaged, taxes inefficient and long-term security plans overlooked.

We combine your personal and business finances into one clear plan for strong wealth protection and solid retirement readiness.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Personal Finance Management Services

Understand your expenses clearly to save more and invest your money wisely.

How EaseUp Makes Finance Management Simple & Smart

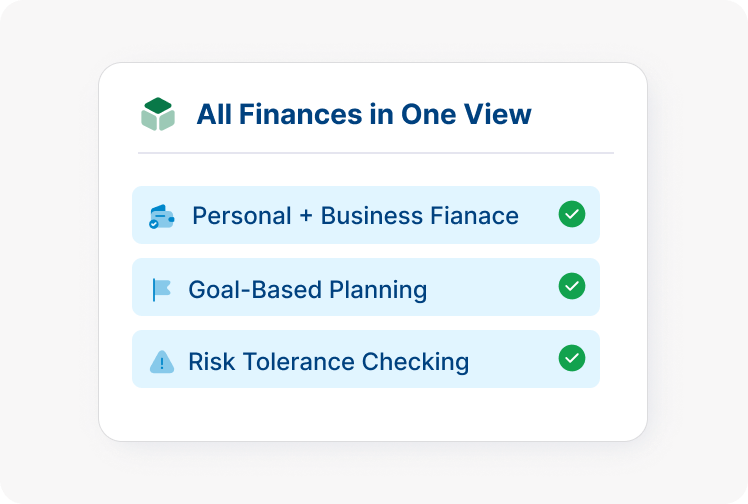

1. Discovery & Wealth Mapping

We analyze your current personal and business financial positions, goals and risk tolerance to see your entire financial picture in one place.

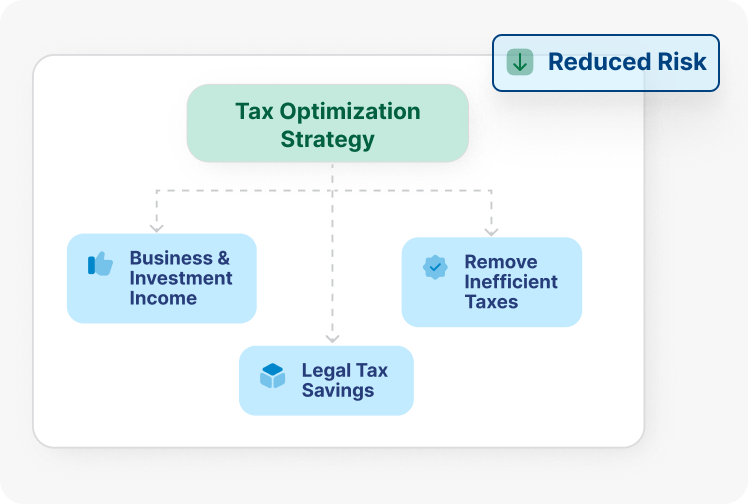

2. Tax Optimization Strategy

Our team finds strong, legal ways to lower your taxes on business earnings and personal investments, to keep more of the money you earn by eliminating inefficient tax structures.

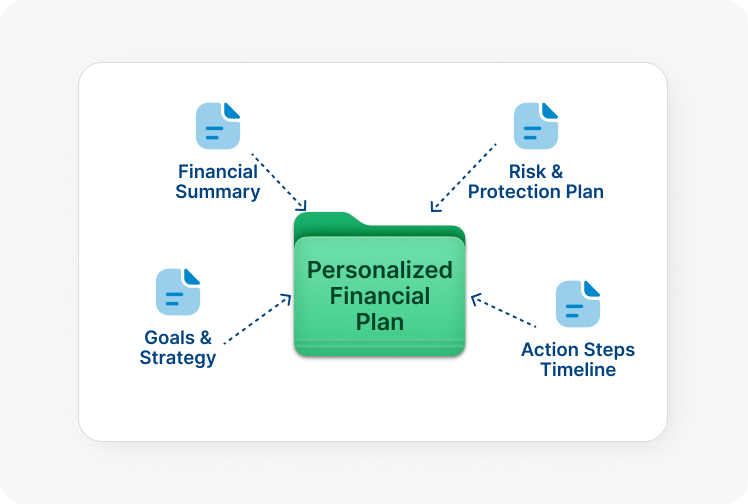

3. Personalized Financial Plan

We deliver one clear, easy-to-follow document that combines all your analyses, strategies and plans, to receive a clear, integrated plan ready for execution.

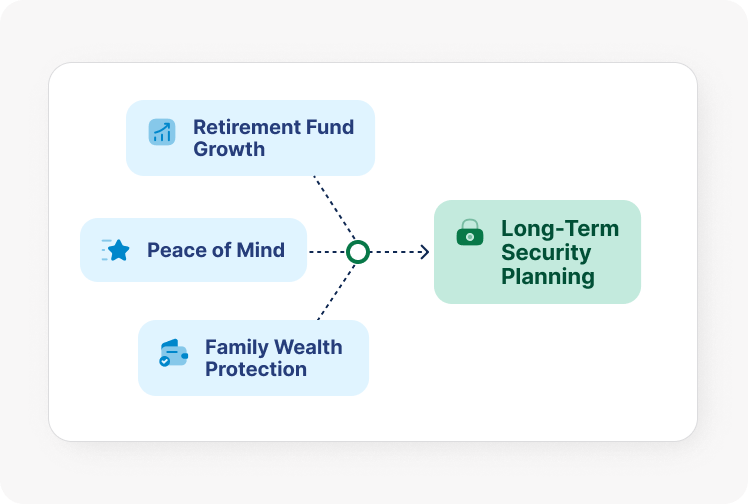

4. Long-Term Security Planning

We develop customized strategies for retirement funding, and family wealth protection, to gain peace of mind knowing your family and long-term financial security are fully protected.

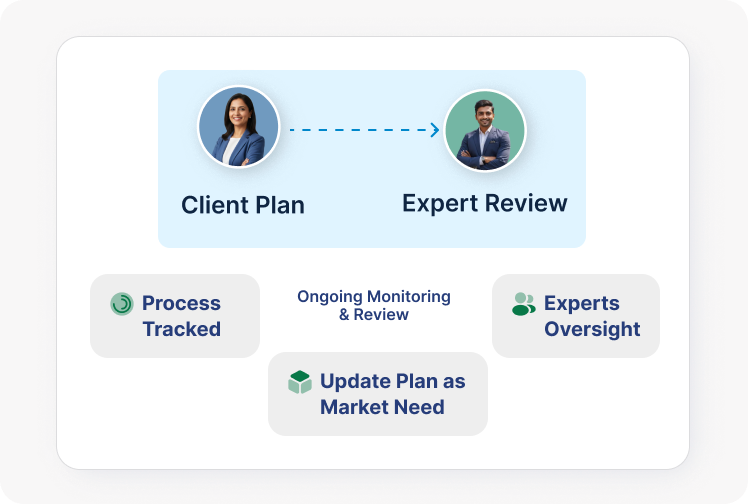

5. Ongoing Monitoring & Review

We hold regular reviews to track progress, update your plan with market changes and adjust for major business wins. So Have an expert partner continuously monitoring and adjusting your strategy.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for Personal Finance Management ?

Specialized Accounting Built for Your Business

Our Pricing Plans

Most Popular

Startup

What you will get

Handling all incorporation and EIN setup.

Support for tracking stock, options, and early equity.

Monthly reporting optimized for funding rounds and due diligence.

S-Corp election planning and guidance on tax incentives.

E-commerce / D2C

Mastering multi-platform sales, inventory valuation, and complex sales tax compliance.

₹7,999

/ per month

What you will get

Seamless sync and reconciliation for Shopify, Amazon, etc.

FIFO/LIFO valuation and accurate Cost of Goods Sold tracking.

Monitoring sales tax nexus and compliance across state lines.

Linking ad platform expenses to specific revenue streams for true profitability insights.

Manufacturing

Tracking production costs, inventory levels, and optimizing profitability per unit.

₹12,999

/ per month

What you will get

Detailed tracking of Direct Materials, Direct Labor, and Manufacturing Overhead.

Accurate accounting for goods still in the production pipeline.

Tracking Raw Materials and Finished Goods to prevent stockouts/waste.

Proper depreciation scheduling for heavy machinery and equipment.

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready to Take Control of Your Personal Financial Future?

Use EaseUp Personal Finance Management tools now to track your spending, create smart budgets and grow your wealth with ease.

Get Started with Stress Free Personal Finance Journey

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Understand Your Financial Position

We review your income, expenses, assets and liabilities to build a clear picture of your current financial health.

Plan & Optimize Your Finances

We create a structured plan covering savings, investments, taxes and goals to help you make smarter financial decisions.

Monitor & Stay on Track

We provide periodic reviews and guidance to ensure your personal finances remain aligned with your goals.

FAQs

Top Personal Finance Management Queries

A financial planner typically focuses on creating your overall plan (budgeting, goals, etc.), while a financial advisor often focuses more heavily on managing your investments. Our service combines both for a comprehensive, holistic approach.