About Us

Resolve Your GST Notices Quickly Without any Penalties

A GST Notice is a formal communication from the Goods and Services Tax department requiring you to explain discrepancies, submit documents, or pay outstanding tax dues within a specified deadline. EaseUp's GST Notice Support services help businesses respond accurately, avoid penalties, and resolve disputes with expert CA assistance.

95%

Client Satisfaction

150+

Trained Caregivers

80+

Families Served

Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Urgent GST Notices Create Stress and can Risk Severe Fines or Audits.

Founders facing urgent GST notices often feel stressed and lose valuable time. These notices can lead to heavy fines, audits, and legal issues for your business.

At EaseUp, we offer fast expert help. We carefully review your notice, write clear, detailed responses, and work to resolve the issue quickly and effectively.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Core GST Notice Support Services

Quickly resolve GST audit questions with precise, complete data and document support.

How EaseUp Makes GST Notice Support Simple & Smart

Notice Analysis and Review

We quickly analyze the type of notice and possible penalties to clearly understand the severity and the best next steps, removing any uncertainty.

Documentation & Data Preparation

We help you collect all important documents, ledgers and data needed to back up your original tax returns. This helps you respond effectively to the claims in the tax notice.

Drafting the Official Response

Our GST experts draft a comprehensive, legally sound reply addressing every point of the notice with clear facts and legal citations. Which will reduces the chances of further queries or appeals.

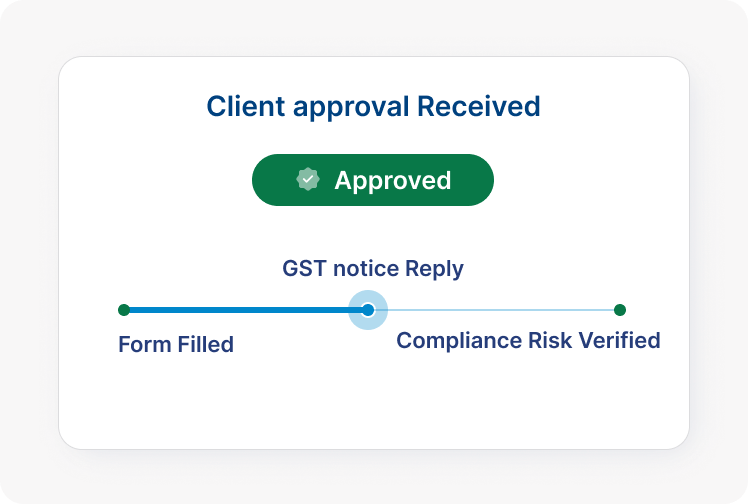

Client Review and E-Filing

You will receive the draft response for your final approval. After you confirm, we submit the reply along with all required forms and proof on the GST portal before the deadline.

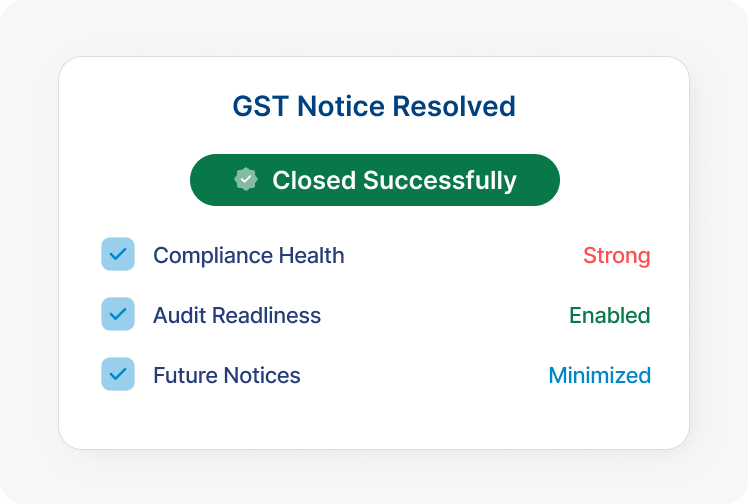

Final Resolution & Future Proofing

We secure the final closure order and recommend internal process changes to help you avoid similar GST notices and reduce future compliance risks for your business.

Key Takeaways: GST Notice Response in India

Essential facts about GST notices every business owner should know:

Response Deadline

GST notices typically require response within 7-30 days. Missing deadlines leads to best judgment assessment, additional penalties, and recovery proceedings.

Common Notice Types

ASMT-10 (scrutiny), DRC-01 (demand), DRC-07 (assessment orders), show cause notices, and ITC mismatch notices are the most common GST notices businesses receive.

Appeal Rights

GST orders can be appealed to the Appellate Authority within 3 months. Pre-deposit of disputed tax (10-20%) is required before appeal filing.

Resolution Cost

Professional GST notice support costs ₹5,000-₹50,000 depending on complexity—significantly less than potential penalties which can be 100% of tax due.

Why Choose EaseUp for GST Notice Support?

Specialized Accounting Built for Your Business

Our Pricing Plans

Most Popular

Startup

What you will get

Handling all incorporation and EIN setup.

Support for tracking stock, options, and early equity.

Monthly reporting optimized for funding rounds and due diligence.

S-Corp election planning and guidance on tax incentives.

E-commerce / D2C

Mastering multi-platform sales, inventory valuation, and complex sales tax compliance.

₹7,999

/ per month

What you will get

Seamless sync and reconciliation for Shopify, Amazon, etc.

FIFO/LIFO valuation and accurate Cost of Goods Sold tracking.

Monitoring sales tax nexus and compliance across state lines.

Linking ad platform expenses to specific revenue streams for true profitability insights.

Manufacturing

Tracking production costs, inventory levels, and optimizing profitability per unit.

₹12,999

/ per month

What you will get

Detailed tracking of Direct Materials, Direct Labor, and Manufacturing Overhead.

Accurate accounting for goods still in the production pipeline.

Tracking Raw Materials and Finished Goods to prevent stockouts/waste.

Proper depreciation scheduling for heavy machinery and equipment.

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready to Resolve GST Notice and Eliminate Penalty Risk?

Work with EaseUp for quick, expert help and a clear plan that ensures fast resolution and compliance confidence.

Get Started with Stress Free GST Notice Resolution

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Notice Review & Issue Identification

We carefully review the GST notice, identify the underlying issues and assess financial and compliance implications.

Data Validation & Reply Preparation

We validate returns, reconciliations and supporting documents and prepare a fact-based, legally sound response.

Filing, Representation & Closure Support

We handle submissions, follow-ups and representation to ensure timely resolution and minimize interest, penalties, or litigation risk.

FAQs

Top GST Notice Support Queries

A GST notice is a formal communication from the tax authority seeking clarification, documents, or demanding payment due to discrepancies found in your filed GST returns, transactions, or compliances. You may have received it due to mismatches between GSTR-3B and GSTR-2A/2B or late/non-filing.