About Us

Secure Capital and Fuel Your Growth by Preparing for Business Loan

Stop letting incomplete financials delay your funding. We provide expert Business Loan preparation and documentation to ensure you secure the capital you need quickly and on the best terms.

95%

Client Satisfaction

150+

Trained Caregivers

80+

Families Served

Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Stop Letting Messy Financials Delay Your Business Loan

Loan applications often get rejected or delayed because financial documents are messy. Banks and lenders need detailed reports that most founders don’t have the time or skills to prepare well.

We create all the lender-ready documents and financial forecasts for you. We handle complex data and reports, making your application clear, professional, and helping you get approved faster.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Business Loan Services

We make sure your statements are accurate and meet all lender requirements for approval.

How EaseUp Makes Business Loan Simple & Smart

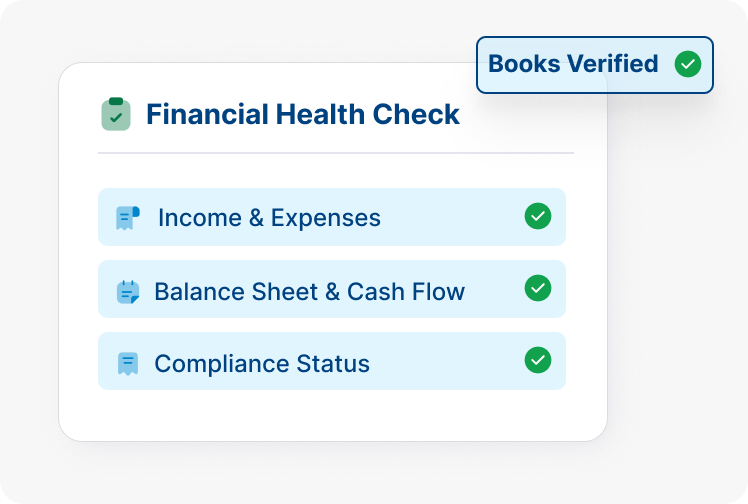

1. Initial Financial Health Check

We audit your current financial statements and books to ensure your financial foundation is strong and fully compliant before you apply.

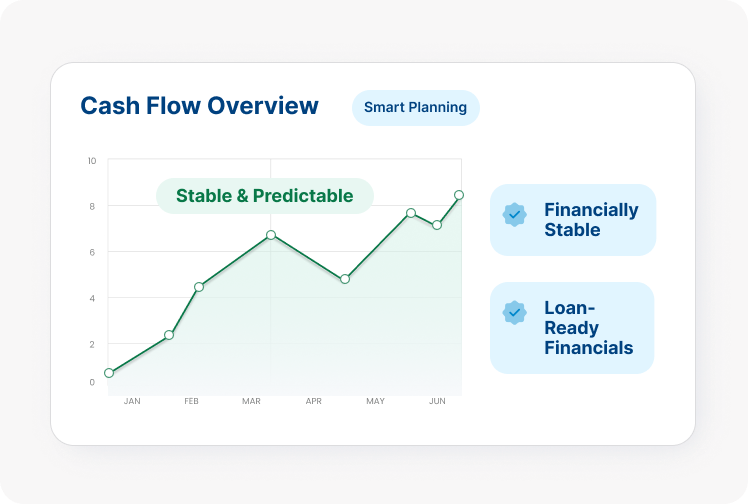

2. Cash Flow & Forecast Modeling

We create clear, reliable cash flow models that provide clear evidence of financial stability and smart planning to approve your loan faster.

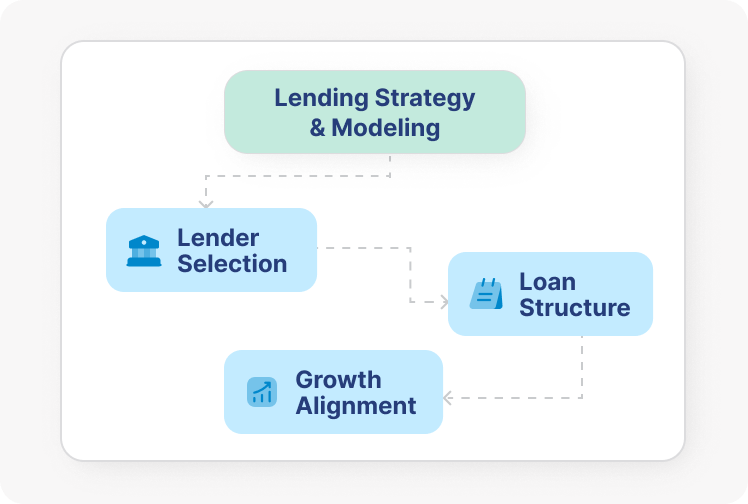

3. Lending Strategy & Modeling

We guide you in choosing the right lender and offer smart advice to finalize loan terms. And make sure the loan structure and terms perfectly align with your business growth objectives.

4. Bank-Ready Proposal Creation

We collect, organize, and submit a complete, error-free loan application for you. Make sure the loan terms and structure match your business growth goals exactly.

5. Submission & Support

We handle your full application and offer financial advice during lender questions, so your application moves quickly through the bank, minimizing delays and securing your capital faster.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for Preparing for Business Loan?

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready to avoid application delays and secure your loan faster?

Don’t let messy documents hold you back. Book a free consultation to get expert loan preparation and speed up your approval.

Get Started with Stress Free Finance Journey

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Financial Health Assessment

We review your books, cash flows, compliance status and key ratios to assess loan readiness and identify gaps.

Documentation & Projection Preparation

We prepare lender-ready financial statements, projections and supporting documents aligned with bank and NBFC requirements.

Application Support & Clarifications

We assist during submission, address lender queries and support clarifications to improve approval efficiency.

FAQs

Top Preparing for Business Loan Queries

The timeline varies depending on the completeness of your existing records, but our streamlined process typically takes between 2 to 4 weeks to deliver a fully bank-ready application package.