About Us

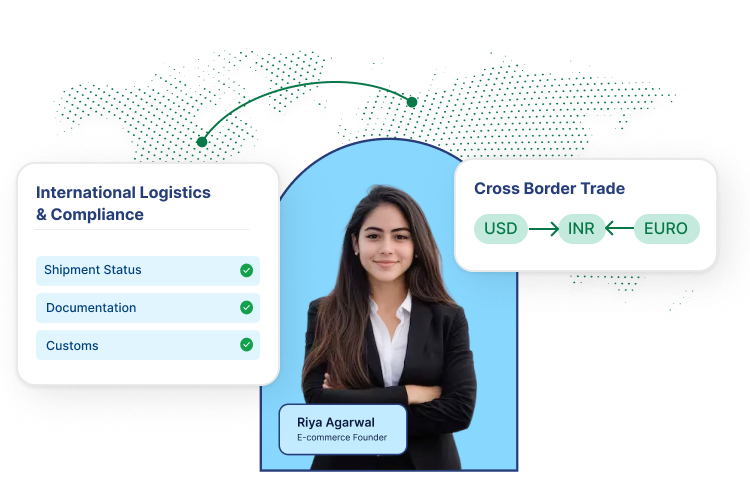

Expand Your Business Worldwide with Easy International Trade Logistics.

Handle international trade, compliance, and cross-border deals smoothly. We offer the skills and services to move your goods and money quickly and easily across borders.

95%

Client Satisfaction

150+

Trained Caregivers

80+

Families Served

Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

Trade Complexity Causes Delays and Blocks Growth Internationally

Expanding globally means facing customs hurdles, regulatory delays, costly currency exchange and high compliance risks that hold back growth.

We simplify the entire cross-border process to speed up customs clearance, offer better currency exchange rates and provide strong, proactive trade compliance management.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our International Trade Services

Quick and compliant registration to officially authorize your company for global trade.

How EaseUp Makes International Trade Simple & Smart

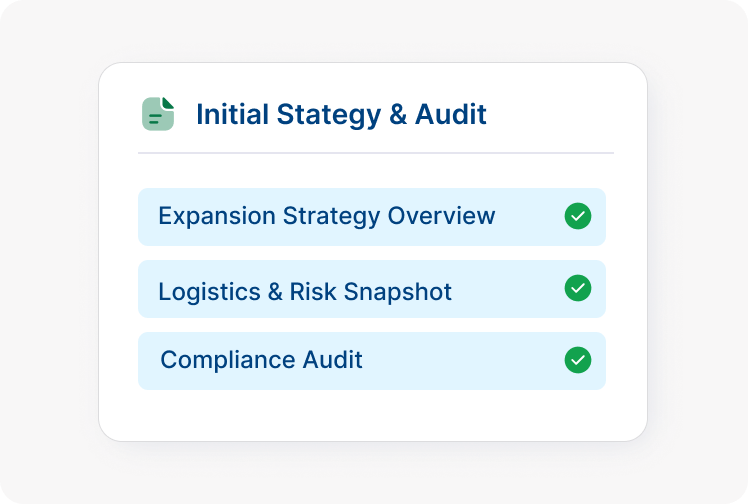

1. Initial Strategy & Audit

We thoroughly review your business goals, target markets, logistics needs and current compliance gaps, to get a precise, strategic plan for expansion.

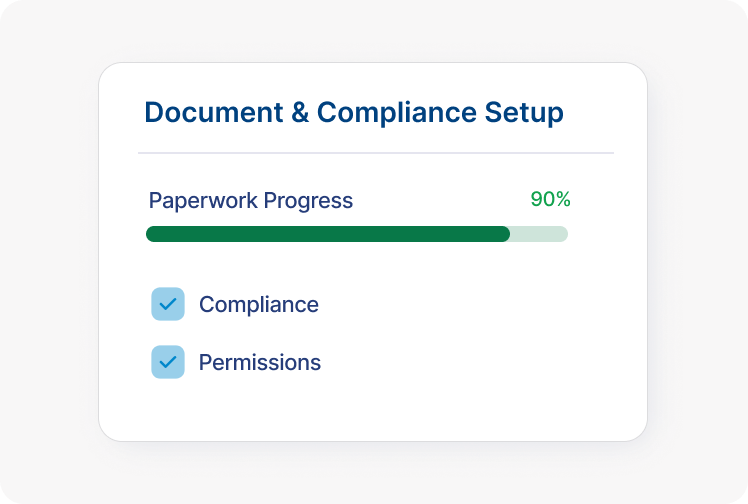

2. Documentation & Registration

We manage and speed up all important paperwork, including Import-Export Code (IEC) registration and initial FEMA compliance documents. This ensures you get the legal permissions needed to start cross-border trade quickly.

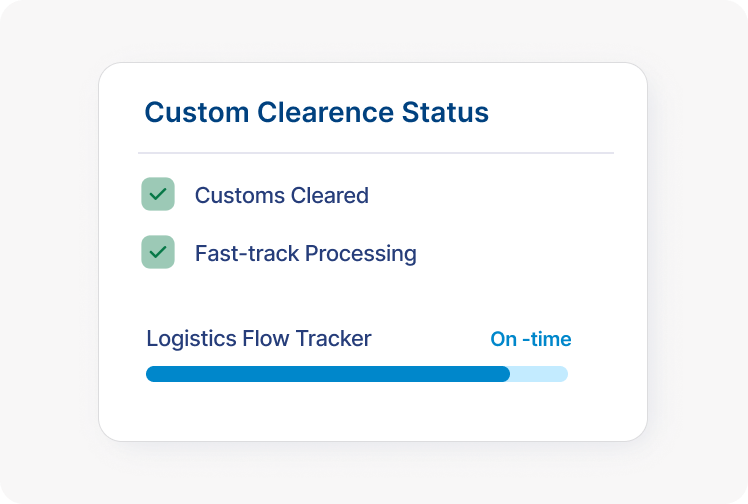

3. Customs & Logistics Optimization

We advise on duty classification, valuation and documentation to help your goods clear customs faster and reduce extra tariffs. This cuts delays and lowers overall costs.

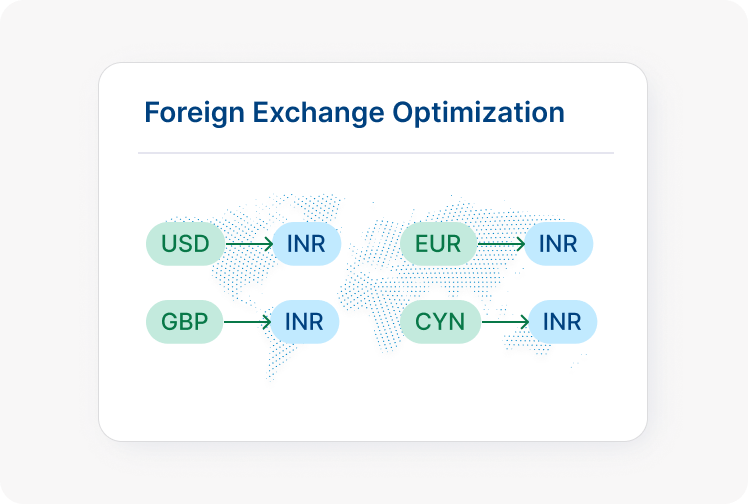

4. Foreign Exchange & Tax Efficiency

We retain more capital by making sure you get the best value on foreign exchange and minimize your global tax footprint.

5. Ongoing Monitoring & Reporting

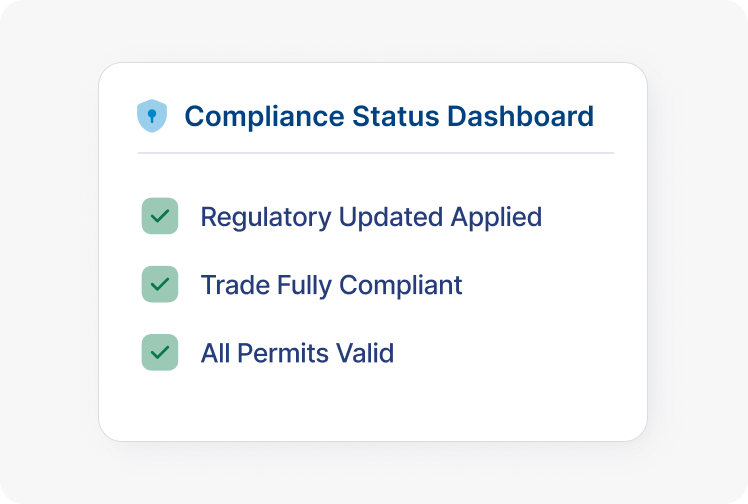

We offer ongoing support to help you keep operations flexible and compliant as you grow and navigate the changing international trade rules.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for International Trade?

Specialized Accounting Built for Your Business

Our Pricing Plans

Most Popular

Startup

What you will get

Handling all incorporation and EIN setup.

Support for tracking stock, options, and early equity.

Monthly reporting optimized for funding rounds and due diligence.

S-Corp election planning and guidance on tax incentives.

E-commerce / D2C

Mastering multi-platform sales, inventory valuation, and complex sales tax compliance.

₹7,999

/ per month

What you will get

Seamless sync and reconciliation for Shopify, Amazon, etc.

FIFO/LIFO valuation and accurate Cost of Goods Sold tracking.

Monitoring sales tax nexus and compliance across state lines.

Linking ad platform expenses to specific revenue streams for true profitability insights.

Manufacturing

Tracking production costs, inventory levels, and optimizing profitability per unit.

₹12,999

/ per month

What you will get

Detailed tracking of Direct Materials, Direct Labor, and Manufacturing Overhead.

Accurate accounting for goods still in the production pipeline.

Tracking Raw Materials and Finished Goods to prevent stockouts/waste.

Proper depreciation scheduling for heavy machinery and equipment.

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready to Launch or Expand Your Business Globally?

Work with EaseUp for expert international trade advice that keeps you compliant, lowers risks and boosts cross-border efficiency.

Get Started with Stress Free International Trade Journey

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Structuring & Compliance Planning

We assist with trade structuring, documentation, customs, GST, FEMA and cross-border compliance to ensure smooth transactions.

Compliance & Financial Feasibility Review

We evaluate tax implications, duty structure, FEMA provisions and cash-flow impact to ensure transactions are compliant and financially viable.

Transaction Review & Ongoing Financial Support

We review trade transactions, monitor cash flows, verify calculations and support compliance filings to prevent errors and financial leakages.

FAQs

Top International Trade Queries

The Import-Export Code (IEC) is a 10-digit number required by all businesses involved in importing or exporting goods and services from India. It is mandatory for customs and other trade-related purposes.