Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

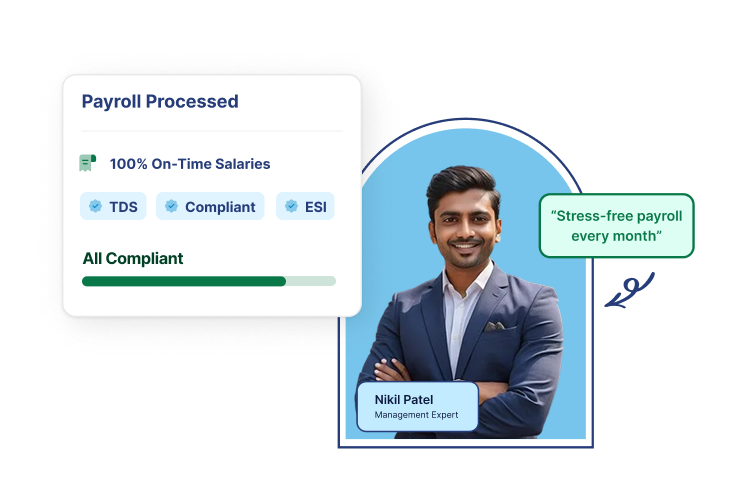

Stop Chasing Payroll. Start Running Your Business

From salary processing to statutory filings, EaseUp ensures smooth, error-free payroll operations so founders and HR teams can focus on growth, not month-end stress.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Payroll Management Services

We design tax-efficient salary structures aligned with income tax laws and other payroll regulations.

How EaseUp Makes Payroll Processing Simple & Smart

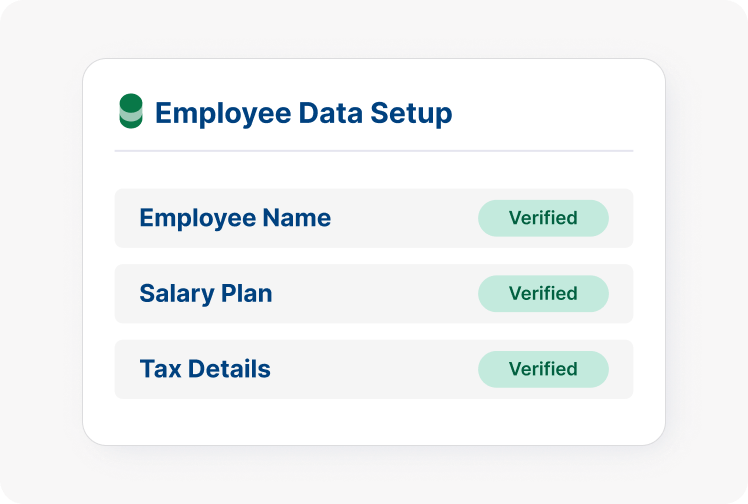

1. Employee Data Setup & Validation

We create and verify employee records, salary plans, tax forms and legal details. This guarantees correct payroll calculations and compliance from the start.

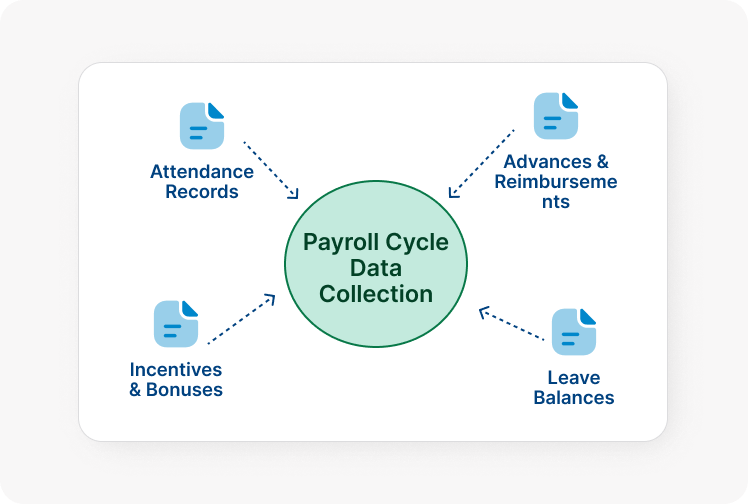

2. Attendance, Leave & Variable Data Collection

We collect and check attendance, leave balances, incentives, advances and reimbursements every payroll cycle. All variable data is verified to prevent errors and disputes.

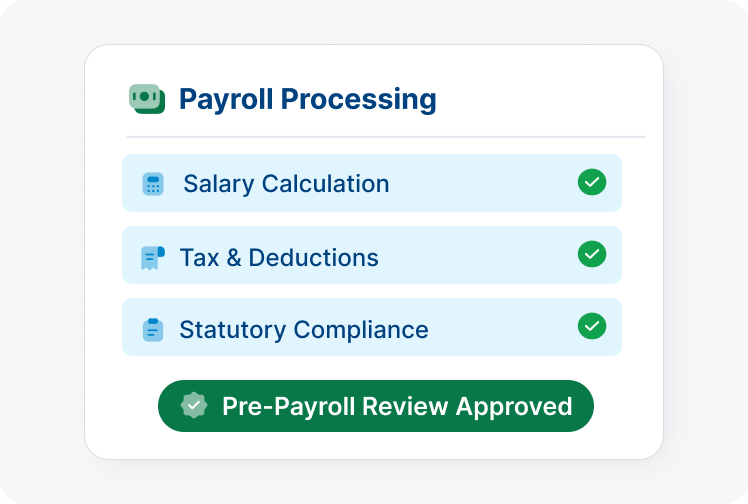

3. Payroll Processing & Compliance Review

We compute salaries, taxes and deductions with multiple checks for accuracy and statutory compliance. A pre-payroll review ensures everything is correct before finalisation.

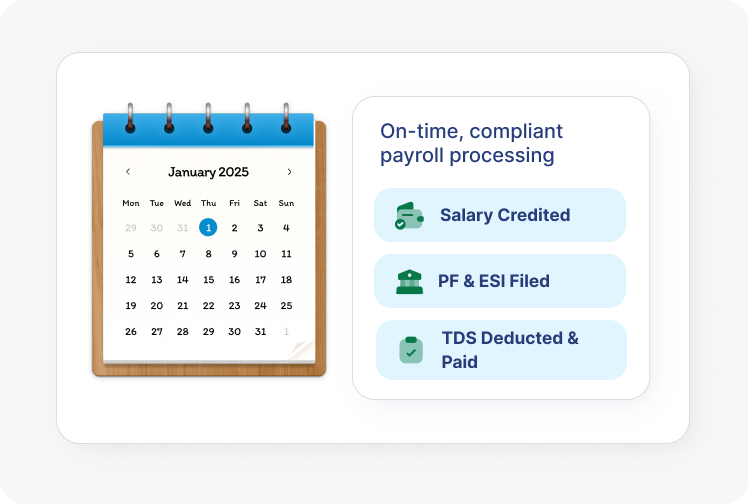

4. Salary Disbursement & Statutory Payments

Salaries are processed on time along with PF, ESI, TDS and other statutory payments. We ensure timelines are met to avoid penalties or employee dissatisfaction.

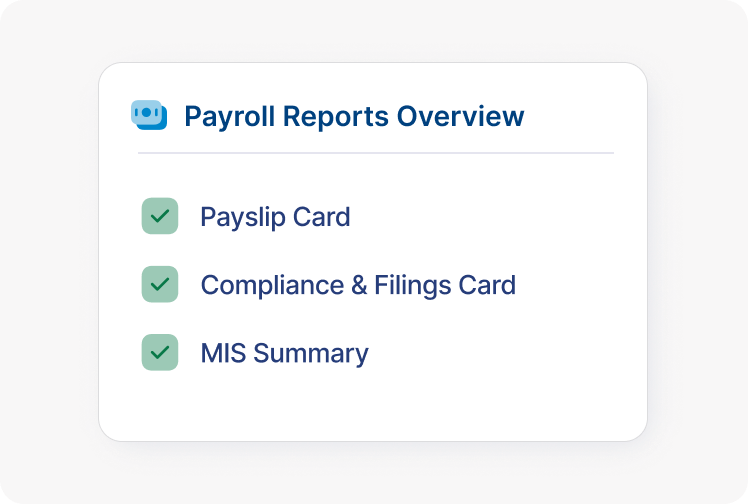

5. Filings, Payslips & Payroll MIS Reporting

We create payslips, handle all legal filings and provide clear payroll reports. This gives management a full view of payroll expenses, liabilities and patterns.

Key Takeaways: Virtual CFO Services in India

Essential facts about Virtual CFO services that every startup founder should know:

Cost Savings

A Virtual CFO costs 60-80% less than a full-time CFO hire. EaseUp's services start at ₹35,000/month vs ₹40-50 lakh/year for a full-time CFO.

When to Hire

Startups should hire a Virtual CFO when reaching seed stage, planning fundraising, or when monthly revenue exceeds ₹10 lakhs and needs strategic oversight.

Core Services

Virtual CFOs provide financial planning, MIS reporting, fundraising support, cash flow management, investor relations, and compliance oversight.

Best For

Virtual CFO is ideal for startups, SMEs, D2C brands, and growing companies that need CFO-level strategy without full-time executive costs.

Why Choose EaseUp for Payroll Management?

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready for Robust & Accurate Payroll Processing?

Take payroll stress off your plate with EaseUp’s structured and compliant payroll management. We ensure error-free payouts, on-time filings and complete visibility every month.

Get Started with Stress Free Finance Journey

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Share Your Payroll Details

Share employee details, salary plans, attendance policies and legal requirements. Our team creates a payroll system that follows all rules and fits your business.

We Run & Manage Your Payroll

EaseUp takes over monthly payroll processing, salary disbursement coordination, statutory payments and filings—ensuring accuracy, timeliness and compliance.

Review, Track & Stay Compliant

Receive payslips, payroll MIS and compliance reports with complete visibility. We handle ongoing updates so your payroll stays smooth as your team grows.

FAQs

Legal Queries Solved

Our software is continuously updated with the latest regulatory changes, and our experts review all filings to ensure full statutory compliance (PF, ESI, PT, TDS).