About Us

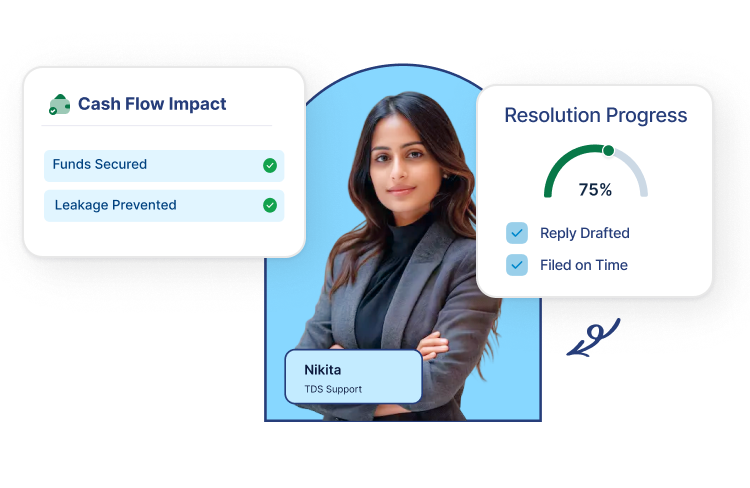

Protect Your Business Cash Flow from All TDS Notices

Get expert help to review, draft replies, and resolve all types of TDS notices, including deficiency, demand and penalty notices. We ensure accurate filings to protect your cash flow.

95%

Client Satisfaction

150+

Trained Caregivers

80+

Families Served

Trusted By

200+ Businesses

Experience the difference of professional financial planning with our proven methodologies.

Effortless GST Filing Stay Compliant, Maximize Savings

Navigating Goods and Services Tax can be complex. Easeupnow makes GST compliance simple, accurate, and stress-free for your business.

TDS Defaults Cause Penalties and Put Your Business Compliance at Risk

TDS notices quickly put pressure on cash flow, require fast and detailed reconciliation and can lead to heavy fines or losing business licenses if ignored.

We offer expert, fast reconciliation and clear response drafting for short deductions, missed filings and demand notices. This ensures quick and effective compliance.

200+

Clients Guided

10+

Years Experience

5+

Organizations

Our Core TDS Notice Support Services

Quickly review the TDS notice and create a clear, compliant action plan.

How EaseUp Makes TDS Notice Support Simple & Smart

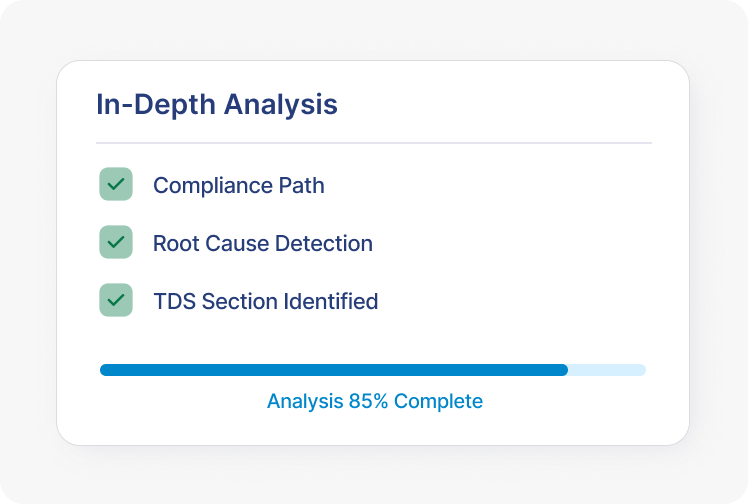

1. In-Depth Analysis

We quickly review the relevant TDS section and map out the compliance steps. This helps us find the exact cause of the notice and the fastest way to meet legal requirements.

2. Document Collection and Preparation

We review your account books and correct any differences. This ensures all data is accurate and prevents future notices about the same error.

3. Filing of Response and Correction

We quickly prepare and file Correction Statements with the Income Tax Department to fix errors in previous filings, reducing the time the issue stays unresolved.

4. Expert Response & Submission

We prepare clear, fact-based responses to notice queries and submit them on time to avoid penalties. All official communications are professional and sent before deadlines to minimize financial risks.

5. Closure & Audit-Proofing Advisory

We secure the final closure order and guide you on steps to prevent future TDS defaults. Get official confirmation and a clear plan for full compliance.

This is the first tool developed

FOR and WITH the help of real Project masters..

SAP S/4HANA

We recognize that managing complex workflow can be overwhelming.

SAP Concur

We recognize that managing complex workflow can be overwhelming.

Cross-Application

We recognize that managing complex workflow can be overwhelming.

Salesforce

We recognize that managing complex workflow can be overwhelming.

Workplay

We recognize that managing complex workflow can be overwhelming.

SAP SuccessFactor

We recognize that managing complex workflow can be overwhelming.

Why Choose EaseUp for TDS Notice Support Support?

Testimonials

12 Years of Trust

and experience in serving businesses of all sizes

"Transitioning to EaseUp’s integrated platform saved our team hours of manual work. Their ability to handle complex compliance while providing real-time financial insights is a game-changer for any modern SME."

"When we faced a complex tax inquiry, EaseUp stepped in with expert precision. Their technically sound responses and professional representation resolved the matter quickly, giving us total peace of mind."

"From GST filings to due diligence, EaseUp manages the heavy lifting. They have a remarkable follow-up system that ensures we never miss a deadline, allowing us to focus entirely on our core business."

"EaseUp didn't just organize our books; they gave us a financial roadmap. Their Virtual CFO services provided the clarity we needed to scale without the overhead of a full-time hire. Truly a strategic partner for our growth."

Ready to Secure Full TDS Compliance Immediately?

Work with EaseUp for quick data matching and skilled filing to fix your TDS notice and prevent any penalties for future also.

Get Started with Stress Free TDS Notice Resolution

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officia consequat duis enim velit mollit. Exercitation veniam.

Notice Review & Default Analysis

We examine the TDS notice to identify defaults related to short deduction, non-deduction, late payment, or filing delays.

Reconciliation & Correction

We reconcile TDS returns with Form 26Q/24Q, challans and Form 26AS, and prepare revised filings or responses as required.

Filing, Representation & Closure Support

We handle online submissions, representations and follow-ups to ensure timely closure and minimize interest and penalties.

FAQs

Top TDS Notice Support Queries

A TDS notice is a communication from the Income Tax Department regarding an identified discrepancy or default in the Tax Deducted at Source (TDS) compliance of an individual or business.